Fed trims interest rates by a quarter of a percentage point

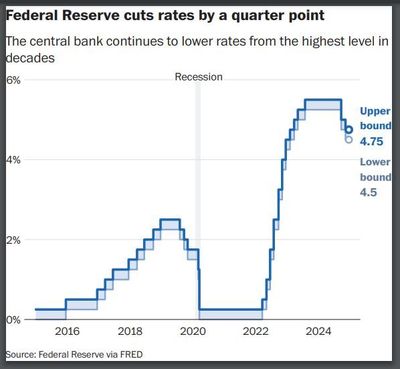

The Federal Reserve lowered interest rates on Thursday by a quarter of a percentage point, its second consecutive rate cut this year, as inflation continues to cool.

The economy continues to grow at a solid pace, the Fed said. Since earlier this year, the labor market has cooled and unemployment has worsened slightly but remained low. Inflation is cooling but remains somewhat elevated.

“The economic outlook is uncertain,” the Fed said in a statement released at the end of its policy meeting.

The rate cut signals that Fed officials are paying more attention to warnings in the economy, including the slowing job market. In September, the Fed reduced the benchmark interest rate for the first time in more than four years, dropping rates by a larger-than-usual half-percentage point.

The Fed’s benchmark rate now sits between 4.5% and 4.75%. Interest rate cuts trickle through the financial sector to make an array of consumer and business loans a little cheaper.

The economy is showing some signs of strength, with promising growth, consumer-spending and unemployment figures released in recent weeks. There are also warning signs: The economy picked up just 12,000 jobs in October, the slowest pace in nearly four years, as a labor market cooldown was exacerbated by major hurricanes and labor strikes.

While the rate cut by the Fed usually leads to lower mortgage rates, something odd happened after the half-percentage point cut in September. Mortgage rates dipped, as expected, but then they went back up, said Michael Wendland, current president of the Coeur d’Alene Regional Realtors.

“Consumer confidence is down,” said Wendland, a Realtor with Century 21 Beutler & Associates in Coeur d’Alene. “Every single day they are seeing something on interest rates or the world economy. We still have buyers and sellers, but buyers are sitting on the fence.

“A lot of them are sayin, ‘I want to wait until the mortgage rate comes down,’ ” he continued. “But what happens if it doesnt? People still have to have a place to live.”

The median home price in Kootenai County in October remained nearly unchanged at $526,292 from last year and home sales ticked up about 10% but the days on market have jumped to 94, or just more than three months.

“Since 2018, we’ve had really low days on market. So there are just a lot of changing dynamics,” Wendland said. “We are still seeing a lot of cash buyers in our market so mortgage rates may not affect them as much.”

As for Spokane County, home sales picked up about 12% in October compared to 2023. The median price ticked upward about 6% to $422,100, but the biggest jumps came in new listings and inventory.

At the end of October, some 1,357 homes remained unsold, which was more than 20% higher than 2023 and new listings were 25% higher, as 804 homes came onto the market, according to information posted by Spokane Realtors.

Election impact

Donald Trump’s presidential victory this week may upend the U.S. economic outlook and the central bank’s future stance on rates. Trump’s campaign commitment to impose tariffs on U.S. imports, to deport undocumented immigrants and to renew expiring tax cuts could, depending on how they are implemented, put upward pressure on inflation. They could also expand federal deficits.

Trump’s big win might make the Fed reluctant to continue cutting rates at a rapid clip. “Various policy uncertainties may lead the Fed to move more slowly than it otherwise would,” JPMorgan Chase & Co.’s Michael Feroli said in a research note on Wednesday.

This week’s Fed meeting lacks the drama of September’s, when the Fed itself was divided on how much to cut and one governor issued a rare dissent. Fed Chair Jerome H. Powell will be pressed for a diagnosis of how the presidential and congressional election results could affect the economic outlook and the Fed’s policy. The Fed closely guards its independence from politics, and Powell isn’t expected to wade into the matter too deeply.

Still, Wall Street will be watching closely for signs of how much more the Fed plans to drop rates over the coming months. Fed officials signaled ahead of the election that they see rates continuing to decline gradually. Their goal is to achieve a so-called neutral rate that doesn’t constrain or spur economic growth. But it isn’t clear precisely what that rate is and it can’t be observed.

Analysts and investors in the futures market believe that yet another quarter-percentage point cut is likely at the Fed’s final 2024 meeting, in December, though the pace of additional cuts next year are uncertain.

While the Fed was practically guaranteed to cut rates at its September meeting, the size of the cut was up for debate. Ultimately, officials decided that the economy was flashing enough warning signs to warrant a jumbo-size cut, and publicly expressed confidence that such a large swing would help ensure that the job market didn’t weaken any more than it already had.

It’s no secret that Trump wants the White House to have more say in the operations of the Fed, particularly regarding its decisions on monetary policy. Last month, Trump said that as president, he ought to have a “right to say I think he should go up or down a little bit” on interest rates. He added, “I don’t think I should be allowed to order it,” he added.

During his first term, Trump publicly flirted with the idea of dismissing Powell as chairman and potentially elevating another Fed governor to the chairmanship. He ultimately did neither.

Some bank executives and former Fed officials say they expect Trump, in a new term, to try a potentially less controversial intrusion on Fed independence by demoting the Fed board member tasked with regulating Wall Street: Biden appointee and former Obama-era Treasury official Michael Barr.

Spokesman-Review reporter Thomas Clouse contributed to this report.