Is Spokane’s housing market finally leveling? The average home in the county saw a slight decrease in value this year

New homes, many of them presold, are shown in the Parkvue Hills subdivision in Spokane Valley on July 9, 2021. (Jesse Tinsley / The Spokesman-Review)

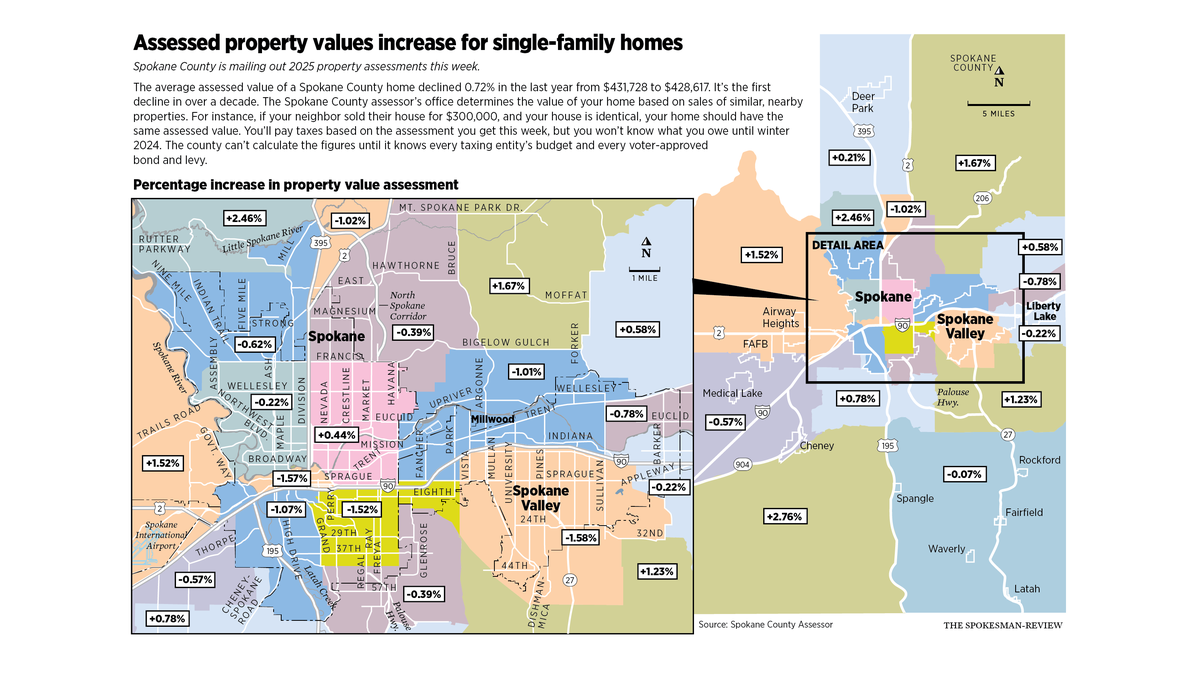

Assessments from 2024 show the average Spokane County home saw a decrease in value year over year, the first decline in the region in more than a decade and a potential indication the market is leveling after years of stark increases.

“It’s nice that we are returning to more of a normal Spokane market,” said Spokane County Assessor Tom Konis. “Because what we have gone through the last three or four years before that was not normal.”

The value of the average Spokane County house dropped year over year from $431,728 to $428,617, a minimal 0.72% decrease. The drop follows a modest 2.4% boost from 2022 to 2023, and a nearly $100,000 jump from 2021 to 2022.

Homeowners across the county have or will receive their property assessments for the 2025 tax year mailed by the assessor’s office late last month. The valuations are the county’s estimates as of Jan. 1 and tend to be lower than what a property would fetch on the market, and vary in decreases and increases from neighborhood to neighborhood.

Konis stressed that if a homeowner’s property goes up in value, it doesn’t mean they’ll experience a proportional tax increase. Homeowners can get an idea of what their tax bill will be come January by using the estimator tool available on the county’s website.

The largest chunk of a homeowner’s taxes – often more than 50% – goes to schools. About 15% of Spokane County property taxes goes to cities and towns. Fire districts get about 12% of the pie, and the county government receives 8%. Smaller pieces go toward road funds, libraries, cemeteries and parks.

Spokane County home values have more than doubled in the last seven years, growing from an average of $209,659 in 2018 to around $430,000 for the past two tax years. Tom Hormel, former president of Spokane Realtors, said the minimal change year over year is an indicator the market is leveling out.

Hormel said the slight drop could be attributed in part to high mortgage interest rates, which have slowed the housing market locally and nationally as rates have rebounded from their historic lows during the COVID-19 pandemic.

“We know we have a massive subset of buyers who are waiting on the sidelines now because of the interest rates,” Hormel said.

The Federal Reserve does not set fixed mortgage rates, but it does greatly influence the market and how those figures are calculated through its policy decisions. The Federal Reserve has held off on cutting rates for several quarters now as they attempt to reduce inflation. Top officials for the central bank have previewed imminent rate cuts in 2024, but reducing the inflation rate has gone much slower than expected. It’s unclear whether those rates will be cut any time soon.

“When they do that, I think you are going to see the real estate market take off again,” Hormel said.

Prospective buyers would be willing to move on houses they’re eyeing, while sellers will be able to go from their current home to one of equal value without having their monthly mortgage payments increase. The bigger the reduction, the longer its effects on the market will last, Hormel said.

The average 30-year fixed mortgage interest rate was 7.01% as of Monday afternoon, according to data from Bankrate, a personal finance company. That’s nearly triple the record low of 2.65% reached in January 2021.

Hormel said the recent plateau in Spokane County is consistent with what’s occurring across the country. While sales have slowed, prices are stabilizing for the most part. That likely signifies a return to normal after red-hot market years in 2020 and 2021, but it can differ by location.

“We’re seeing similar things all across the country,” Hormel said. “There’s pockets where the market is moving quickly and there’s pockets where it’s slowed a bit.”

Spokane County home values may have settled, but it doesn’t mean more residents are able to upgrade their living situations or become first-time homeowners.

Prices still remain out of reach for the average Spokanite, and high interest rates only compound the affordability problem, said Patrick Jones, executive director of Eastern Washington University’s Institute for Public Policy and Economic Analysis. Wages also haven’t kept pace with the housing market.

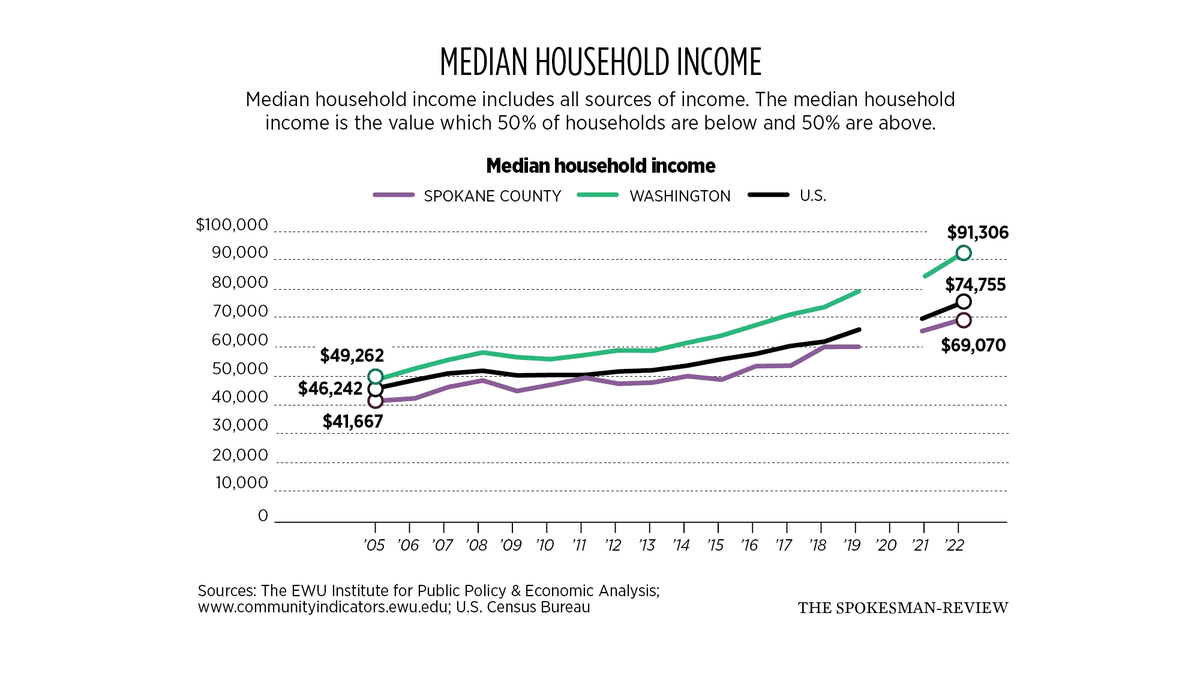

In 2022, the median income of Spokane County households was about $69,000. That’s a jump of about $9,000 from 2019.

However, incomes in the county still lagged behind the national median of $74,755 in 2022 and well below the statewide median of $90,325.

“These are modest percentage increases,” Jones said. “Nothing that would keep stride with the rise in housing prices over that interval.”

Jones’ team evaluates the affordability of housing in the region by using the Housing Affordability Index calculated by the Washington Center for Real Estate Research. The index measures the ability of a middle-income family to make mortgage payments on a median-priced home, assuming it came with a 20% down-payment and a 30-year fixed mortgage. It assumes the family is paying no more than 25% of their monthly income on principal and interest payments.

Middle-income families in Spokane County have been paying more than 25%, the benchmark for affordability, since 2020, according to the institute’s data.

Housing is even more unaffordable for first-time buyers who are assumed to be buying cheaper houses with lower incomes. First-time buyers haven’t been near that 25% benchmark since late 2017.

Spokane County homes remain more affordable for residents than the statewide average, but only marginally so, Jones said. Nationally, home prices are vastly outpacing wage growth, with a 74% rise in prices from 2010 to 2022. Meanwhile, the average wage rose only 54%, according to the Federal Housing Finance Agency.

Jones said the stagnation in housing prices is a bit of respite for those ready to purchase a home, but is not necessarily an indicator the affordability crisis will diminish in the near future.

“It’s good for a lot of people to see prices moderate, because a substantial number of would-be home buyers have been priced out,” Jones said. “They’re sitting on their hands, so having a bit of a lull in the rapidly increasing housing market prices is probably a good thing.”

This article was updated to describe Tom Hormel’s role with the Spokane Realtors group.