Democrats gear up to pass $1.9 trillion stimulus without Republican support, reviving debate over national debt

FILE - In this Jan. 7, 2021 file photo, a "Help Wanted," sign is shown in the window of a souvenir shop in Miami Beach, Fla. Hiring has weakened for six straight months. Nearly 10 million jobs remain lost since the coronavirus struck. And this week, the Congressional Budget Office forecast that employment won’t regain its pre-pandemic level until 2024. (Associated Press)

WASHINGTON – President Joe Biden came into office just over a month ago calling for a return to bipartisanship. That same day, he also called on Congress to pass a sweeping stimulus package.

It appears he can’t have it both ways.

Congressional Democrats are gearing up to pass Biden’s $1.9 trillion “American Rescue Plan” in the House on Friday and squeeze it through the narrowly divided Senate on an expected party-line vote before enhanced unemployment benefits and other protections expire in mid-March.

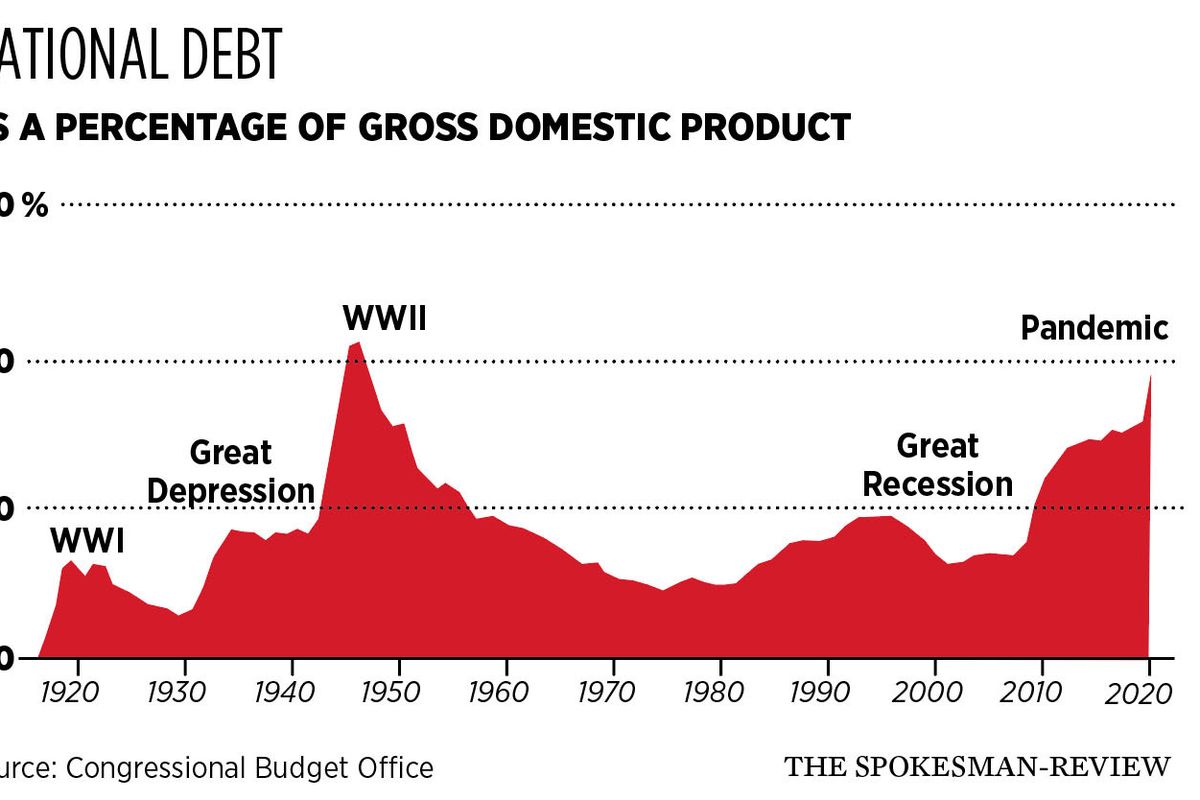

The spending package has reawakened a partisan debate over the national debt that was largely dormant under the Trump administration. GOP lawmakers decry the legislation as overly broad and warn it would increase the national debt to an irresponsible level, while Democrats say the spending is necessary to defeat the pandemic and spur an economic recovery.

Rep. Russ Fulcher, a Republican who represents North Idaho, said he worries too many lawmakers have lost sight of the national debt.

“I still believe that our debt is our No. 1 challenge,” Fulcher said. “Every time we vote on one of these (spending bills), this is an invoice that we’re sending to our grandchildren.”

A Feb. 11 report from the nonpartisan Congressional Budget Office projected the national debt in 2021 would surpass the size of the entire U.S. economy, even without the massive new spending bill. That had happened only once before since the end of World War II – in 2020, due largely to the economic downturn caused by the pandemic and the more than $4 trillion in relief spending Congress approved to combat it.

The report predicted a federal budget deficit – the difference between what the government spends and total revenue – of $2.3 trillion for fiscal year 2021, roughly $900 billion lower than the previous year. Each year the country runs a deficit, it’s added to the debt. As of Tuesday, the national debt stood at $27.9 trillion.

Interest payments on that debt cost the United States $345 billion in fiscal year 2020, roughly equivalent to the combined budgets of the Departments of Education, Homeland Security, Housing and Urban Development, Justice, Labor, Energy, State, the Interior, and Commerce.

Democrats say the economic health of the nation is bigger than the deficit and debt alone, and stimulus spending could yield a strong return on investment in the form of a swifter economic rebound. Rep. Pramila Jayapal, a Seattle Democrat who leads the Congressional Progressive Caucus, cited the low interest rates that have caused some economists to rethink the conventional wisdom on federal borrowing.

“The reality is that we haven’t done enough in this moment of terrible crisis,” Jayapal said. “We still have a million new people every week who are filing for unemployment and we still have a pandemic raging and half a million people who have died, so the government needs to step up.”

With odds of GOP support looking bleak, Senate Democrats are set to pass the $1.9 trillion package through the budget reconciliation process, which lets lawmakers bypass the 60-vote majority needed to pass most legislation in the upper chamber.

Congressional Republicans have cried foul, accusing Biden of reneging on his pledge for unity. In response, the White House has adopted a broader definition of bipartisanship, pointing to support for the stimulus plan from GOP governors, mayors and voters.

A Morning Consult/Politico poll released Wednesday found 76% of voters – including 60% of Republicans – support Biden’s stimulus plan. West Virginia’s GOP Gov. Jim Justice said Feb. 1 Congress should set aside deficit worries and “go big” on stimulus spending, and several Republican mayors have called for more aid to local and tribal governments.

In a letter to Congress on Wednesday, the CEOs of more than 150 companies called on lawmakers to “act swiftly and on a bipartisan basis to authorize a stimulus and relief package along the lines of the Biden-Harris administration’s proposed American Rescue Plan.”

But even the Senate’s most moderate GOP members have turned their backs on Biden’s sprawling stimulus plan after Biden dismissed their $618 billion counteroffer in early February. In separate op-eds in the Wall Street Journal and the Washington Post on Tuesday, Republican Sens. Mitt Romney of Utah and Rob Portman of Ohio urged Democrats to compromise.

While Democrats argue passing the package is urgently needed in a pandemic, Republicans have derided it as a wish list of longstanding Democratic priorities. Romney pointed to a Congressional Budget Office analysis showing more than one-third of the money it approves wouldn’t be spent until 2022.

“With the president’s so-called COVID relief bill, what are we doing with it?” Fulcher said. “We’re doing a minimum wage bill. We’re doing billions to public transit. We’re doing state and local bailout money. What does that have to do with anything? You’ve got to question motive, at that point.”

Democrats say the money to state, local and tribal governments – which was left out of the roughly $900 billion bipartisan relief package Congress passed in December – is needed to address budget shortfalls. The proposal calls for $20 billion to go to public transit agencies.

Democrats may have to scrap a provision to increase the nationwide minimum wage to $15 an hour by 2025 after moderate Democratic senators have expressed concerns. Lawmakers also are awaiting a ruling from the Senate parliamentarian, the nonpartisan referee who will decide whether a minimum wage boost could be passed through the reconciliation process.

Central to Republican opposition to the Biden stimulus plan is their objection to increasing the federal budget deficit and adding to the national debt.

Bill Gale, a senior fellow in economic studies at the Brookings Institution, a nonpartisan think tank, has written extensively on the dangers of an increasing national debt but said, “This is not really the time to worry about it.”

“The only way we get a handle eventually on the long-term debt is with a strong economy,” Gale said. “Even if you care about long-term debt, the right thing to do is to focus on the virus first, the economy second and the debt third.”

Gale, who served on the White House Council of Economic Advisors under President George H.W. Bush, said the amount the government borrows matters less than how it is spent.

“If you’re going to fund your vacation on a credit card, that’s a bad idea,” he said, comparing government spending to a personal finance decision. “If you’re going to invest in a house or a business, that’s potentially a good idea.”

“We have to remember that there’s two sides to the problem – not just what the government borrows, but what it does with the money. Borrowing to invest more would be a way of both addressing the current shortfall and creating a stronger economy in the long run to deal with the long-term debt.”

As for the GOP’s objections to increasing the deficit, Gale said that’s hard to square with the party’s support for the massive tax cut bill Republicans passed in 2017, also using budget reconciliation, that the Congressional Budget Office projected will increase the deficit by $1.9 trillion over a decade. The national debt rose by nearly $7.8 trillion under the Trump administration.

“I think the Republican opposition to deficits is disingenuous at best,” he said. “They don’t seem to mind deficits that are caused by tax cuts. We’ve seen them pivot on deficits consistently over the last 10 years. Every time there’s a Republican president, they’re fine with it.”

Concerns about the deficit and national debt seldom come from the party in power and serve as a reminder of fundamental differences between the parties. Democrats complain when GOP tax cuts raise the deficit and Republicans do the same when a Democratic majority boosts spending.

As long as voters like lower taxes and more government spending on programs that make lives better, the national debt is likely to keep rising. The changes that could reverse that trend – tax increases and benefit cuts – are a political third rail few politicians want to touch.

“To ignore it is irresponsible,” Fulcher said. “But any political leader is signing their own political death warrant if they go make it their rallying cry to reform Social Security or Medicare, and it’s got to be those two things that get overhauled or amended if you’re really serious about dealing with the debt.”

Gale said the increasing national debt is a real concern in the long run, but the U.S. should look to the last time it faced such high debt relative to the size of its economy as an example of what the stimulus could do.

“The deficit in World War II was enormous, but we knew why we had it,” Gale said. “Our country, our world, is a much better place because the U.S. invested in World War II. That’s a classic example of an investment that paid off. Likewise, if we can get the virus under control, that would be an enormous boon to the economy.”