McConnell: Democrats ‘won’t get our help’ to lift debt limit

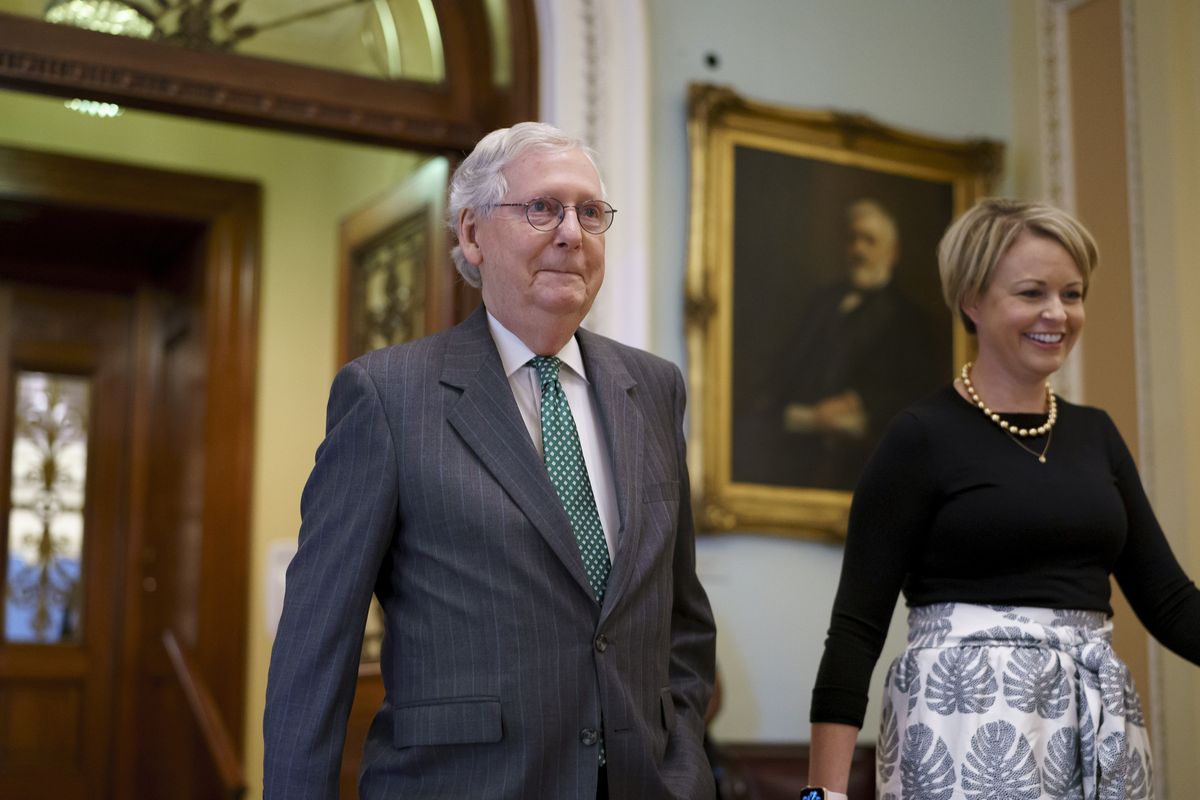

WASHINGTON — Republicans will oppose raising the federal debt limit if Democrats pursue their $3.5 trillion, 10-year plan to strengthen social and environment programs, Senate Minority Leader Mitch McConnell said Thursday.

The Kentucky Republican’s threat was the most explicit he has been about his desire to force Democrats to either take the politically unpopular step of unilaterally renewing the government’s borrowing authority or pare back President Joe Biden’s domestic policy agenda.

His remarks suggest that another high-stakes budget showdown between the two parties, with the government’s financial soundness in the balance, may be on tap. The party not controlling the White House often uses such moments to seek leverage, such as when Republicans pressured President Barack Obama into a 2011 deal that cut spending.

The government’s ability to borrow cash to finance its operations expired Aug. 1, when a two-year-old temporary suspension of borrowing limits lapsed. The Treasury Department has used accounting moves ever since to keep the government afloat, but the nonpartisan Congressional Budget Office has projected that such actions will suffice only until October or November.

If the government loses access to fresh money, it could prompt a federal default, which has never occurred. Analysts have said that could badly wound the economy, perhaps over the long term, forcing up interest rates and federal borrowing costs.

Last month, McConnell said he couldn’t “imagine a single Republican” voting to raise the spending ceiling in an environment of “free-for-all for taxes and spending.”

On Thursday he was more explicit. His remarks came days before Democrats plan to begin pushing a budget resolution outlining their $3.5 trillion domestic programs package through the Senate. Republicans are poised to oppose that resolution unanimously.

“If our colleagues want to ram through yet another reckless taxing and spending spree without our input, if they want all this spending and debt to be their signature legacy, they should leap at the chance to own every bit of it,” McConnell said on the Senate floor.

“Let me make something perfectly clear: if they don’t need or want our input, they won’t get our help. They won’t get our help with the debt limit increase that these reckless plans will require,” he said.

Democrats control the 50-50 Senate only with Vice President Kamala Harris’ tiebreaking vote. On most bills, Republicans use filibusters to force Democrats to get 60 votes to halt the delaying tactics. McConnell’s comments indicated that GOP senators would not provide the needed support.

Legislation renewing the government’s ability to borrow money incurs no new debt and simply pays for already enacted spending and tax breaks.

Democrats are not without options, but none is risk-free and they’ve not yet decided what to do.

At least for now, they seem unlikely to pare back their plans to bolster education, health and environment programs that are the backbone of Biden’s policy aspirations. But some moderate Democrats are reluctant to vote to renew federal borrowing powers without at least some GOP backing.

They could put language suspending the debt limit anew in a bill Congress will have to approve by Oct. 1, the start of the government’s new budget year, to keep agencies open. That would force Republicans to decide whether to provide the needed votes for a bill that, if defeated, could cause the government to both default and close its doors.

Democrats could put provisions raising or suspending the debt limit into the $3.5 trillion bill they plan to write this fall that would enact the specific tax and spending changes envisioned in their budget resolution. Democrats plan to use special procedures to shield that bill from a GOP filibuster, but it might not be ready before the Treasury exhausts its accounting maneuvers.

The government’s current debt ceiling is $28.4 trillion. Federal borrowing has grown at record rates amid programs aimed at supporting the pandemic-battered economy.