Spokane Valley leaders don’t plan to raise taxes this year, but may need to in the future

Spokane Valley leaders won’t increase taxes this year, but may consider doing so in the future as funds the city has relied on to pay for streets and other projects begin to wane.

According to 2020 preliminary budget documents, city staff describes funding of road maintenance as a “constant challenge.” The city has been using general fund, reserve, capital project money as well as other funds to pay for roads since 2012. While there is still surplus money projected and the city’s reserves are not depleted, several leaders are looking for new ways to fund street repairs.

Spokane Valley Mayor Rod Higgins said “everything is on the table,” when looking at other sources of revenue next year, including a property tax increase.

“That’s what we’re confronted with,” he said, “It’s possible our current revenue isn’t working.”

While the city has budgeted to spend less than it collects for several years, some consistent taxes, such as the gas tax and the telephone tax, have remained flat or decreased. Spokane Valley relies on those taxes to pay for street maintenance. That is true for the city’s gas tax, which saw a slight bump due to an increase from the state Legislature, but has been decreasing as vehicles become more fuel efficient. It’s projected to be a about $2 million next year.

The city’s phone tax has dropped about 5.4% a year since it was first collected in 2009, and next year it’s projected to be about $1.5 million, half of what it was in 2009, according to the 2020 preliminary budget.

The 2020 budget will be the 11th consecutive year Spokane Valley City Council hasn’t taken a 1% property tax increase. Under state law, governments are allowed to increase property taxes by 1% a year without putting a levy on the ballot. When a government doesn’t increase it by 1%, that capacity is “banked” and the government can increase taxes by more than 1% without the voters weighing in. Spokane Valley has banked more than $600,000 over the past decade, which would be an estimated 37 cents per $1,000 of property tax increase if the council voted to collect it.

Higgins, said he might support a much smaller tax hike if the city needed it, because dramatically increasing property taxes in one fell swoop would be a sudden and significant tax increase for Spokane Valley property owners.

“(Their) income hasn’t gone up like that,” he said.

Arne Woodard, who also plans to look into other taxes this year, said increasing property taxes would erase Spokane Valley’s competitive edge, and do more harm than good to property owners with fixed incomes.

“The property tax doesn’t give us what we need, it harms the people that it’s supposed to help,” he said.

Woodard said he doesn’t yet know what other taxes the city should consider, and their options could be limited by an initiative on the ballot, backed by anti-tax activist Tim Eyman, that would restrict car tabs to $30. Woodard, as well as Wick, are both interested in potentially starting a Transportation Benefit District which would use car tab or sales tax funds to pay for road repairs.

“It’s going to come down to creative options,” Woodard said, “but I don’t know what those are yet.”

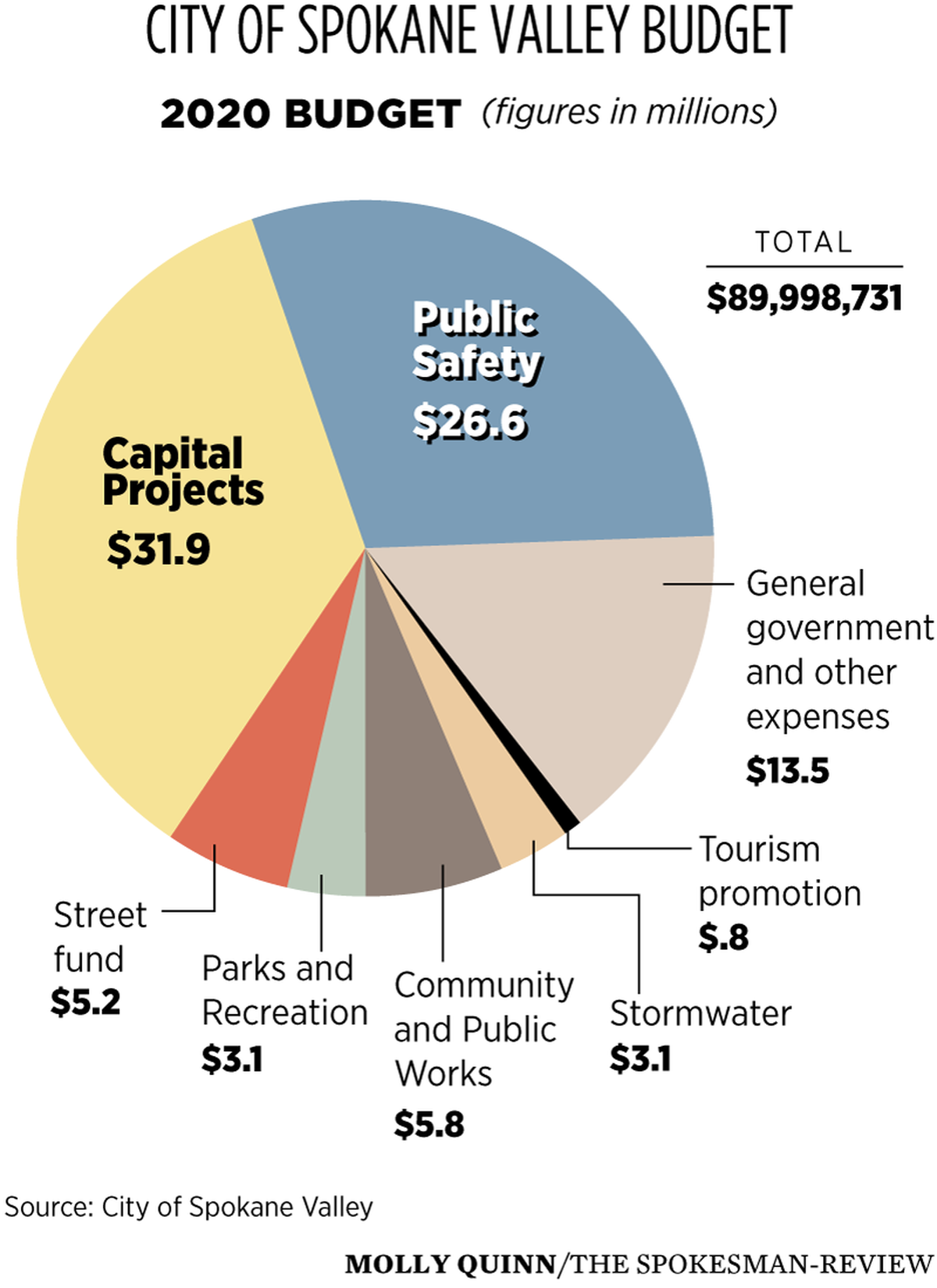

The City of Spokane Valley has about 99,000 residents, has a budget of about $90 million and just under 100 employees. Most of the city’s services are contracted, which is what City Councilman Ben Wick said has allowed them to kept their expenses down, avoid layoffs during difficult economic times, and in the last several years, roll over millions in surplus revenues which has been used for capital projects and street repairs.

Wick said he is interested in creating a Transportation Benefit District, if voters don’t approve the $30 car tab initiative this November, but said the city has consistently had more revenue than expenditures, which it could use to continue to pay for streets.

Wick said the city should use the surplus money it already has before asking voters for more money. He said streets are important, and there usually is enough extra money to invest in streets and other projects council prioritizes. Wick acknowledged Higgins’ and Woodard’s criticism of using surplus, saying it’s harder to plan for than a consistent, dedicated tax.

“It’s not as reliable,” Wick said, “but we’ve always had rollover in the history of our city, we’ve always projected expenses high, revenue low.”

Councilwoman Brandi Peetz, also has suggested using surplus money to pay for streets before looking to new taxes.

Wick said raising property taxes is the “last resort” and said it’s possible the city could use that money for public safety, or other growing expenditures, but it should use what it has before looking for more.

Next year, the city is also budgeting for 1.5 more positions. There will be funding for a Code Enforcement Officer and increasing an attorney position from part time to full time. Next year, there will be three employees dedicated to code enforcement full-time.

City Staff will be working on the 2020 budget for the next several weeks and will have a series of presentations during council meetings. There will be a budget hearing on Oct. 8 and the first reading of the budget will be at the end of October. A final reading is scheduled for Nov. 12.