Bunker Hill Mining behind on payments to owners of historic Silver Valley property

Bunker Hill Mining Corp. made a big splash in March when company officials announced they were leasing the historic Silver Valley property with eventual plans to reopen the lead-zinc-silver mine.

This week, however, the Toronto-based company revealed it was behind on $400,000 in lease-purchase payments to the Bunker Hill Mine’s owner. The company has until Oct. 14 to make the outstanding payment, according to a news release.

“Bunker Hill is working with urgency to resolve this matter,” a company statement said.

Bruce Reid, Bunker Hill Mining’s chief executive officer, led a successful turnaround at another Silver Valley property, the Galena Mine, before selling his part ownership in 2008.

In an earlier interview, Reid said he’s been interested in the Bunker Hill Mine since he studied the property in a geology class at the University of Toronto. He tried to buy the mine earlier, but the price was too high at the time.

Bunker Hill Mining is leasing the underground mine from Placer Mining Co., with an option to purchase it.

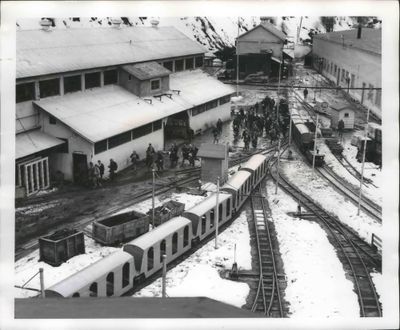

In 1885, Noah Kellogg discovered the lead outcropping that became the Bunker Hill Mine. The mine and a smelter operated for nearly a century.

Under an agreement announced in March, Bunker Hill Mining agreed to pay $20 million to the federal government on Placer Mining’s behalf over seven years.

The payments will help the U.S. Environmental Protection Agency recover part of the $24 million the agency has spent on water treatment at the mine, which releases about 1,300 gallons of water polluted with heavy metals per minute.

Resolving the mine’s environmental claims was hailed by the parties as a significant step that could lead to reopening the mine.