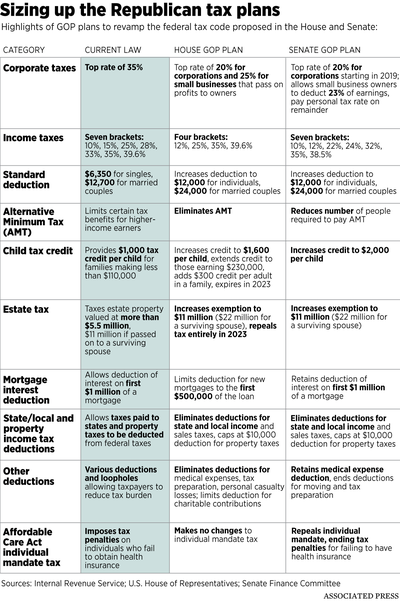

Senate versus House tax plans: A comparison

The Senate passed a tax reform bill well past midnight Friday in Washington, D.C., that would make major changes to the federal tax code by significantly lowering corporate taxes, while making more modest changes to individual tax bills.

A number of changes were added hours before a vote, with some provisions handwritten on the main bill, prompting criticism from Democratic senators.

Here’s a rundown of the Senate’s bill as compared to the House of Representatives’ plan, which was passed in November.

Individual tax brackets

The Senate plan keeps seven tax brackets, as under current law, while the House plan consolidates them down to four: 12 percent, 25 percent, 35 percent and 39.6 percent.

The Senate’s lowest bracket would remain at 10 percent, while the highest would fall from 39.6 percent to 38.5 percent, giving many people earning several million dollars a year a cut. Other brackets would see slightly lowered rates, typically 2 to 3 percent.

Corporate taxes

Both bills would cut the current tax rate on corporations from 35 percent to 20 percent. The Senate bill would make that change in 2019, while the House would do so immediately.

The House bill also cuts the rate to 25 percent for small businesses passing on profits to owners. The Senate bill allows small business owners to deduct 23 percent of earnings and pay a personal tax rate on the remainder.

Standard deduction

Both plans nearly double the standard deduction, from $6,350 for singles to $12,000, and from $12,700 for married couples to $24,000.

Higher education

The House bill would count graduate students’ tuition waivers as taxable income. That means a student who receives free tuition in exchange for research or teaching would be expected to pay taxes on the amount of tuition being waived, even though the student never sees a penny of that money.

The Senate bill does not include this provision, but would levy a 1.4 percent investment income tax on college and university endowments exceeding $500,000 per student at universities with more than 500 students.

Child and family tax credits

Both bills expand the child tax credit and raise the income threshold at which it starts to phase out.

The House bill expands the credit to $1,600 per child and begins to phase it out for married couples making more than $230,000. The Senate bill expands the credit to $2,000 per child, with a phaseout beginning at $500,000 of a couple’s income.

Mortgage interest deduction

Currently, homeowners can deduct mortgage interest from the first $1 million of home debt. The Senate keeps that limit in place, while the House bill caps it at the first $500,000 of debt.

State and local tax deduction

Both bills would allow a deduction of up to $10,000 for state and local property taxes only, with no deductions for sales or other taxes.

Other deductions and credits

The House bill originally got rid of a tax credit for adoption but added it back in after objections from some GOP lawmakers. But the bill still eliminates deductions for high medical expenses and student loan interest. The Senate bill would leave the adoption credit, as well as those deductions, intact.

Both bills eliminate deductions for moving expenses and tax preparation.

Obamacare mandate

The Senate bill repeals the Affordable Care Act requirement that individuals buy health insurance coverage. Currently, the mandate is enforced via a tax penalty for people who fail to purchase coverage.

The House bill does not touch the mandate.

Estate taxes

Both bills would double the exemption for the estate tax to about $11 million for an individual and $22 million for a couple.

The House bill would completely repeal the estate tax starting in 2023, while the Senate bill would simply index the exemptions to inflation.

Information from the Associated Press was included in this report.