Airbus wins more orders, Boeing nets more cash

Company admits problems with superjumbo, cargo programs

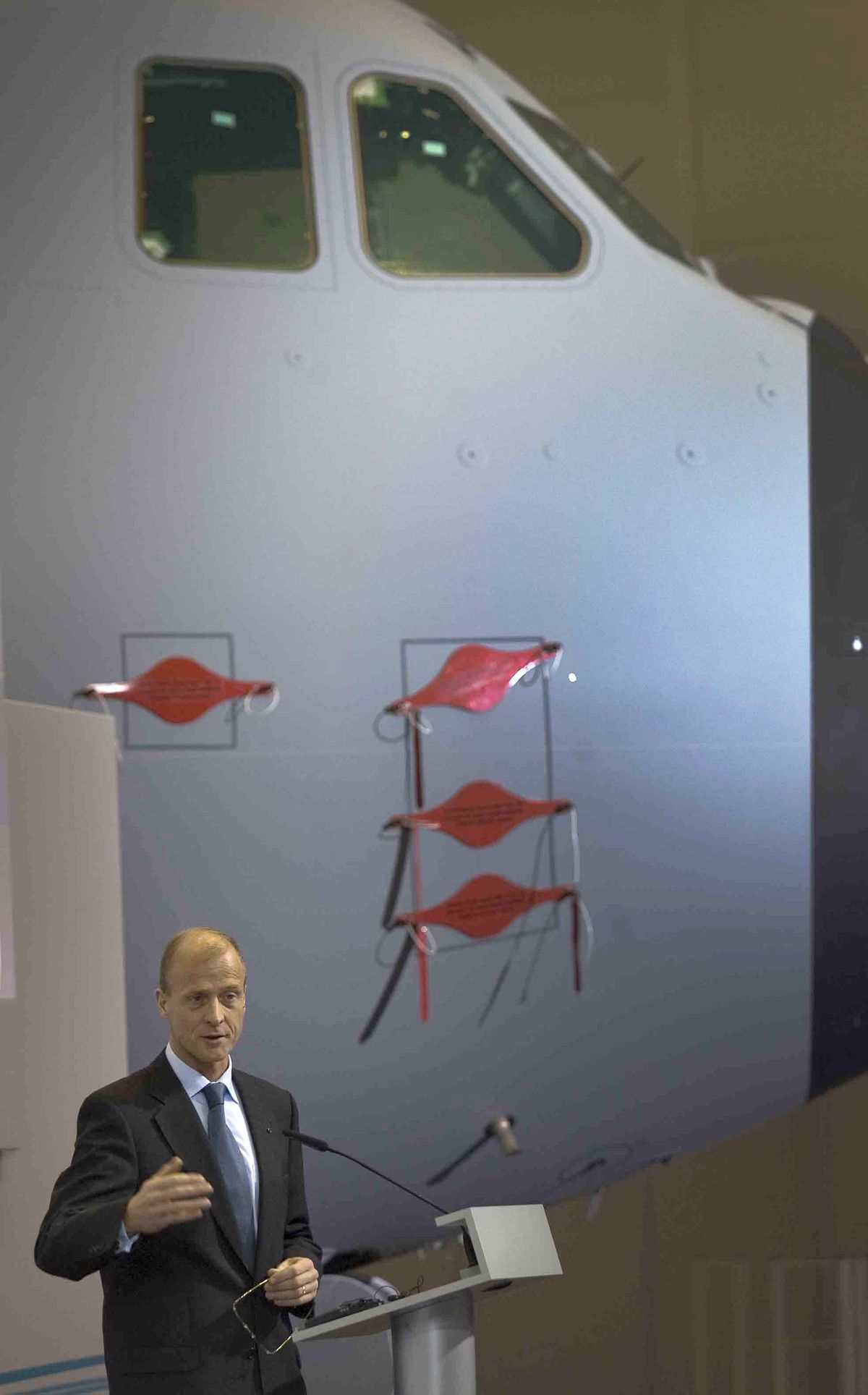

Airbus and EADS executives pose for pictures in front of the Airbus A400M military aircraft in Seville, Spain, on Tuesday.

SEATTLE – Airbus topped Boeing both in the number of planes produced and in the total of new orders last year, but the U.S. company prevailed in perhaps the most important tally: the actual money received for airplanes delivered to customers.

Whether calculated on list prices or on more realistic data using standard sales discounts, Boeing’s deliveries were worth about $4 billion more than Airbus’s.

Airbus said Tuesday that it won 271 net orders versus Boeing’s 142, and delivered a company record 498 airplanes compared to Boeing’s 481. The European plane-maker’s executives also conceded serious problems with the A380 superjumbo jet program and with the money-draining A400M military cargo plane.

Orders and deliveries are the numbers that get the most attention, but from a business perspective, the value of deliveries is key.

According to data from aircraft valuation firm Avitas, after standard sales discounts the Boeing jets delivered in 2009 were worth an estimated $32.8 billion.

Airbus’ 2009 deliveries were worth an estimated $28.4 billion.

Despite delivering 17 fewer airplanes, Boeing produced a more valuable mix: Airbus’s output of the more expensive large jets didn’t match Boeing’s 777 production line in Everett.

Airbus rolled out only 20 of its larger-sized wide-bodies: only 10 from the moribund A340 program and another 10 from the A380 superjumbo program, which has slowed to a crawl because of production issues.

In contrast, Boeing rolled out 88 of its expensive large wide-body 777s in 2009, a record pace.

In addition, Boeing delivered eight of its pricey 747-400 jumbo jets before it suspended that assembly line last May as it transitions to the new model 747-8.

According to the catalog list prices of the airplanes delivered, not allowing for discount pricing, Boeing’s delivery total is $55.1 billion compared to Airbus’ $51.6 billion.

That outcome fits the pattern of recent years, though the Machinist strike in 2008 that stopped production for two months meant Airbus beat Boeing in the value of its jet deliveries that year.

But in 2007 and 2006, Boeing topped Airbus both in the number of new jet orders and in the dollar value of jet deliveries.

At the Airbus news conference, chief executive Tom Enders spoke of two issues that Boeing executives will watch closely as they consider their own corresponding moves.

He said Airbus expects to roughly maintain production rates in the year ahead. And the leadership will decide whether to go ahead with a new engine program for the A320 narrow-body family.

Enders also said Airbus should cancel the delayed and over-budget A400M project if customer governments fail to commit more funds soon because it is swallowing money and valuable resources.

And he acknowledged a “big disappointment” with Airbus’ newest plane, the A380 superjumbo, which has suffered from costly delays. Airbus’s 10 deliveries last year were well below its initial goal of 18, and Enders said the program will be “a financial liability” for years to come.

At the same time, the hulking gray A400M turboprop, which made its first flight only last month, is costing $145 million each month and valuable engineering resources, Enders said.

EADS CEO Louis Gallois called some of the A400M arrangements imposed on the company by governments “baroque.” He said governments should resolve the issue of who pays for the extra costs “no later than end of January.”

“The A400M puts all of Airbus in jeopardy,” Enders said.

In its main jetliner business, Airbus survived a crisis year for the airline industry to post better results than Boeing on both orders and deliveries.

“Under the circumstances it was a rather good year,” Enders said.

The European planemaker captured 310 gross orders in 2009, within the target range set by chief salesman John Leahy a year ago. The net tally of 271 beat Boeing’s 142 after the Chicago-based rival suffered multiple cancellations of its delayed 787.

Leahy said he expects between 250 and 300 gross orders this year.

He denied that Airbus gained more orders than Boeing because it is offering bigger discounts. “We never had cheaper planes,” he said.

Enders said he expects deliveries in 2010 to remain at the same level as the past two years, and has no plans to slow down production schedules for any of its planes.

Enders said that in 2010 he plans to make a decision on whether to put new engines on the A320 to keep up with competition – a decision he described as crucial.

“That’s our bread-and-butter business,” he said. “If I get that wrong, I would be in serious trouble.”