Treading lightly

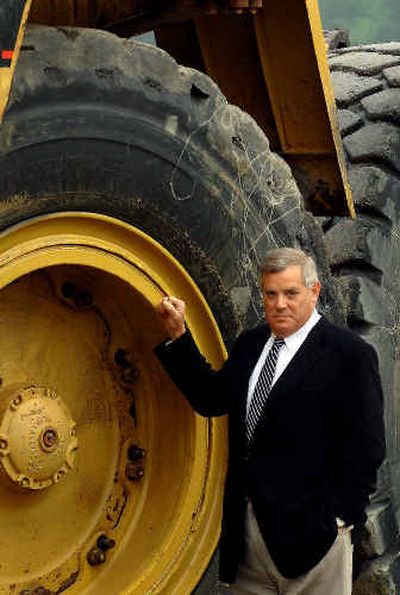

CHARLESTON, W.Va. — Steve Walker was ready to sell four massive, 200-ton dump trucks, with price tags as high as $3 million, when the orders were canceled.

The buyer, a coal company planning to open a new mine site, was ready to buy. It just couldn’t find the 12-foot-tall tires to get the trucks rolling.

The mammoth tires, which can cost up to $30,000 apiece, are in short supply worldwide, leaving earth-moving industries including coal in a lurch. The shortage is due to a rise in equipment orders, an increase in worldwide mining because of increased mineral prices and growth in China and other Asian counties.

Few manufacturers produce the giant tires, and those that do say they’re working around the clock to improve efficiency and fill orders. At Goodyear Tire & Rubber Co., company spokesman Dave Wilkins said every large tire produced through 2006 is already spoken for. Industrywide, demand is expected to outstrip supply until 2007.

In the coalfields of Central Appalachia and across the country, that means coal operators, equipment sellers and tire dealers are constantly searching for replacements. And when they get one, it doesn’t last long. At a surface mine, the life expectancy for heavy machinery tires is about six months.

“There are eight people trying to get the same tire,” said Walker, president of Walker Machinery Co. in Belle, W.Va.

The shortage comes at a time when coal and mineral mining companies are trying to take advantage of high prices. West Virginia is the nation’s second-largest coal producer, and Central Appalachian coal is selling on the spot market for about $65 a ton, according to the Energy Information Administration, part of the Department of Energy.

“This demand is unprecedented in the history of the industry and was unanticipated by the industry,” said Prashant Prabhu, president of Michelin Earthmover Worldwide. “Market growth has simply outpaced all expectations.”

Between 2003 and 2004, demand for large tires grew 20 percent. For some sizes, demand was up 30 percent.

But production levels had remained essentially flat since 1999 and only recently increased, said Jack Fenner, director of dealer sales for Continental Tire North America in Charlotte, N.C.

“When you have pent-up demand, it usually busts loose,” he said. “I think it got us all flat-footed.”

“A lot of this has to do with the growth of developing nations, China being one of them,” said Chris Karbowiak, vice president for public affairs with Bridgestone Americas Holding Inc. “What you’re also seeing in the world is raw material prices are going very, very high.”

What’s unusual is that the economic growth and increasing prices for raw materials are occurring at the same time, putting increased pressure on both large equipment and tire manufacturers, Karbowiak said.

Tennessee-based Bridgestone/Firestone has a large-tire plant in Illinois and is spending millions to expand capacity at its Japanese plant to address the shortage in Asian markets. But that plant won’t be operational until the end of next year.

Michelin, which has a large-tire plant in South Carolina, announced earlier this month it is building one in Brazil. The plant is expected to come on line in mid-2007, serving North and South American markets.

Unlike passenger car tires, which can be produced by the hundreds per day, it may take a whole day to produce a single large earth-moving tire, said Kevin Rohlwing with the nonprofit Tire Industry Association in Bowie, Md.

“Companies are pumping out new tires as fast as they can,” he said. “Everything they are building is sold.”

Appalachia Tire Chairman Walt Dial has been in the business since 1959, operating in five states and supplying many coal industry customers from his Charleston W. Va. headquarters. He has 138 tires on backorder and said stock hasn’t been this tight since the Alaskan pipeline was built.

“The customers really get stressed out if we don’t get more products in,” he said.