Wall Street caps nine-day run, gains 72 points

Wall Street capped a stellar week by extending its rally for a ninth straight session, as a better-than-expected employment report boosted stocks and gave investors hope that the economy was strengthening. The week’s gains were among the strongest of the year, with the Dow Jones industrials having their best week since early 2003.

The 337,000 jobs created in October were nearly double what Wall Street expected. The strength of the Labor Department figures, which included upward revisions of the August and September figures as well, allowed investors to overlook an unexpected jump in the unemployment rate to 5.5 percent, up from 5.4 percent in September.

However, some investors feared that the increase in wages flowing into the economy could trigger inflation. That prompted a selloff on the bond market, with the yield on 10-year notes reaching 4.18 percent. Investors grew increasingly certain that the Federal Reserve would raise interest rates in both its November and December meetings to combat the inflationary pressure.

“You absolutely have to have Fed action both months now,” said Doug Sandler, chief equity strategist at Wachovia Securities. “The saving grace for the economy this year has been no inflation, and a big component of that is wages. When there are more wages, inflation becomes a factor. We haven’t seen it yet, but it becomes a concern that the Fed will have to face.”

The Dow Jones industrial average rose 72.78, or 0.7 percent, to 10,387.54, the Dow’s highest closing level since June 30.

Broader stock indicators were moderately higher. The Standard & Poor’s 500 index was up 4.50, or 0.4 percent, at 1,166.17, surpassing Thursday’s mark, which had been the highest close for the index since March 19, 2002.

The Nasdaq composite index gained 15.31, or 0.8 percent, to 2,038.94, it’s best close since June 30.

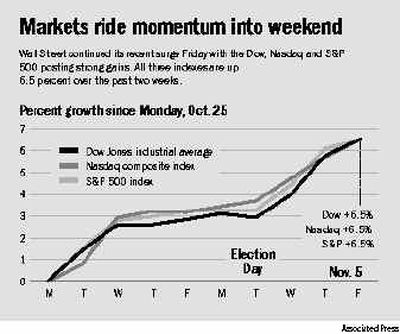

Since Oct. 25, the Dow has been up in eight of the last nine sessions, while the S&P 500 and Nasdaq enjoyed nine straight gains, buoyed by lower oil prices, President Bush’s election victory and the jobs report. For the week, the Dow gained 3.59 percent — it’s best week since March 25, 2003 — while the S&P rose 3.18 percent and the Nasdaq climbed 3.24 percent.

The monthly payroll report is considered to be a key barometer of economic growth, and had been lagging for months as the economy’s summer “soft patch” lingered into the third quarter.

Declining issues barely outnumbered advancers on the New York Stock Exchange, where volume was heavy.

The Russell 2000 index of smaller companies was up 2.16, or 0.4 percent, at 604.29.

Overseas markets fed off of Wall Street’s ongoing rally, as Japan’s Nikkei stock average rose 1.06 percent for the session. In Europe, Britain’s FTSE 100 closed up 0.24 percent, France’s CAC-40 gained 0.49 percent, and Germany’s DAX index climbed 0.55 percent in late trading.