CdA tech startup Rohinni starts getting national attention

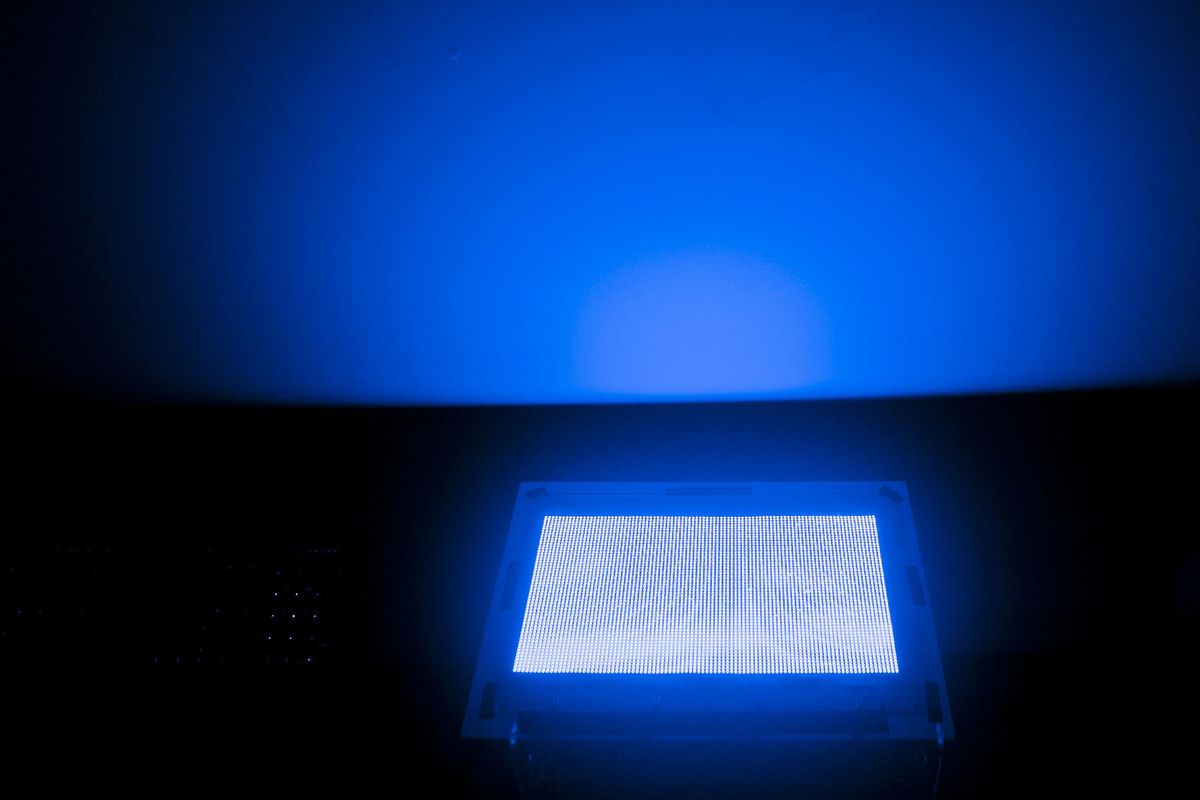

The Pixey light panel is on display at Rohinni in Coeur d’Alene on Tuesday, Nov. 28, 2017. (Kathy Plonka / The Spokesman-Review)Buy a print of this photo

A Coeur d’Alene tech startup has began to get national attention as it looks toward what appears to be a bright future.

Rohinni, a company that produces microscopic LED lights, was recently mentioned in an article published by CNBC that looked at 29 tech startups that are not only innovative, but could receive large investments in the next two years.

This media coverage comes after a year of success for the company founded in Coeur d’Alene in 2013 by Cody Peterson and Andy Huska. This year, the company increased its employeesfrom 20 to 30, said CEO Matt Gerber, and it signed a joint venture and two major contracts.

The company has developed a way to make microscopic LED lights that can be placed on almost anything. Right now, most LEDs require bulky packaging, but Rohinni’s LEDs – 250 microns long by 125 microns wide by and 80 microns tall – can be placed unpackaged on nearly any surface. mMicron is an abbreviated term for micrometer, or a millionth of a meter. A human hair is usually 70 to 180 microns wide.

Without having to package the LEDs, Gerber said, the company can place thousands of microscopic lights in a small space, while saving energy.

“This allows us to put light in places where we could not put light before,” Gerber said.

Rohinni has received 60 patents from the U.S. Patent Office for its LEDs, the processes and the machines and robots used to make them.

“Andy and Cody are true visionaries,” said Nick Smoot, founder of Mountain Man Ventures, an investment group based in Coeur d’Alene that backs Rohinni. “It is exciting to see things that locals have worked so hard on getting the attention it deserves.”

But it’s not just Rohinni’s technology that is capturing the tech world’s attention, it is one of the company’s investors. In 2014, Tony Fadell invested in Rohinni, becoming one of the company’s largest backers. Fadell is somewhat of a celebrity in the tech realm. He is a former Apple executive who is credited with developing the iPod and the iPhone. In 2014, he sold his home automation company Nest to Google for $3.2 billion.

“I’ve been doing LCDs and displays since 1990, 1989,” Fadell said in an interview with tech magazine Fast Company in May. “We’ve always had problems with backlighting. We’re always trying to make backlights thinner, higher power. And I’ve seen all the different technologies. But what Rohinni was showing, was like ‘Look, we can make it incredibly bright and we can make it incredibly thin, too.’ There were not trade-offs.”

Where to start

Even though Rohinni had really interesting technology, Gerber said, the company had to figure out what market it should try to break into first.

“Let’s pick a market that is big enough to be interesting but small enough that if we screw it up, it doesn’t kill the company,” Gerber said.

The first product it focused on was keyboard backlights.

“We ended up looking at the supply chain for the notebook computer arena. We decided the logical insertion point is the guy who is building the keyboard for the suppliers,” Gerber said.

While being able to make the backlights could in the end be very profitable, Gerber said, a lot of risk would have been involved and Rohinni would have had to get a lot more people to help shoulder that risk from an investment standpoint. So they went out looking for a joint venture.

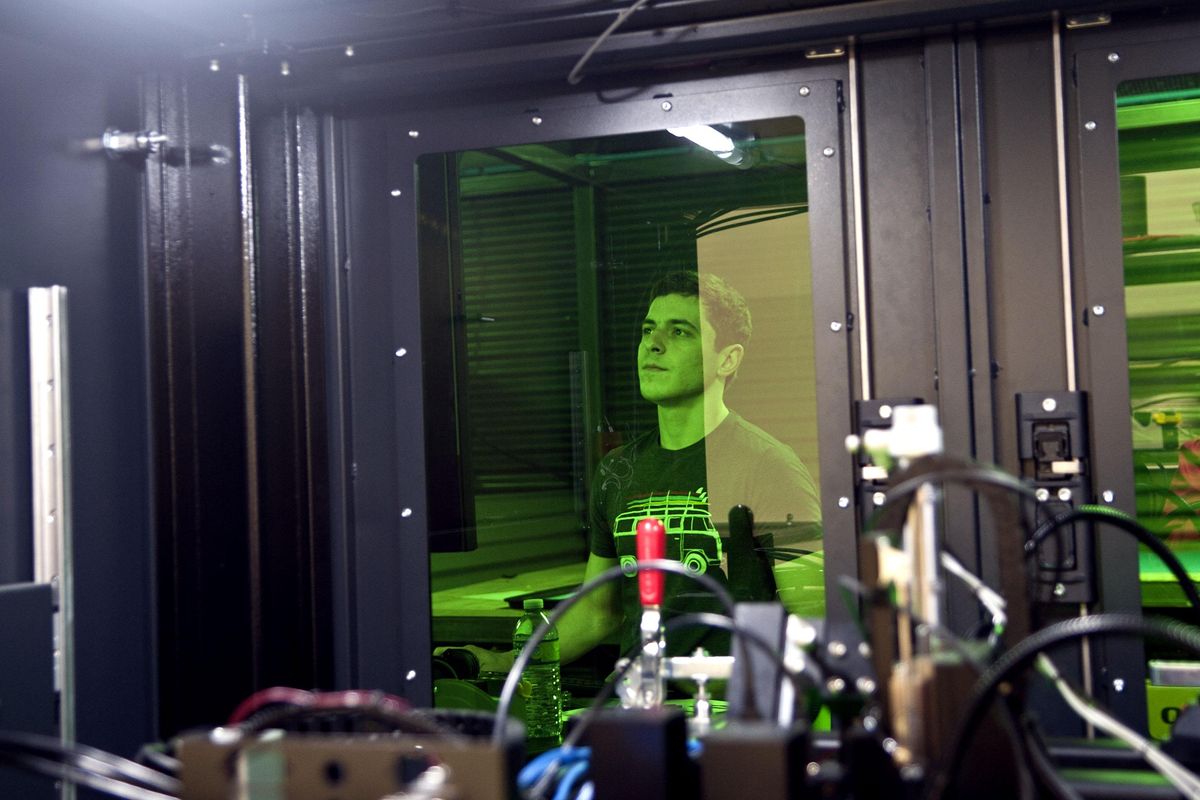

In January, the company announced a partnership with KoJa, a Taiwanese company that is one of the leading providers of keyboard membrane switches. The venture, which goes by the name Luumii, has operations near Shanghai with 25 employees. Rohinni has two robots making the LEDs in China, Gerber said, and two more are expected to be operational later this month.

“We think we’ll have our first production win by year-end,” Gerber said while knocking on a wood table in Rohinni’s Coeur d’Alene offices.

The year, the company also signed two contracts to put its LEDs in the products of household-oriented companies, Gerber said. Under the agreements, he said he couldn’t identify the companies or the amount of money involved.

The first contract is with a consumer electronics company. Rohinni will be making the backlight for a 13-inch display with 6,000 LEDs in it, Gerber said. For comparison, Gerber said employees at Rohinni tore apart a new TV and counted 800 LEDs. With thousands more lights, he said, screens can be brighter and offer more contrast and better picture quality.

Gerber said there are a lot of auto applications for Rohinni’s technology.

“We’re working with a major household name in automotive,” he said. “I cannot be specific about what we are doing for them, but if you have ever seen a car taillight assembly, it is pretty thick. Imagine something a lot thinner that used less energy.”

Gerber said he has had a lot of ideas on Rohinni’s technology how could be used, including in cellphones, advertising,clothing and greeting cards, but he said before the company makes a big move into another sector, the it plans on going further into where it is already.

“We’ve only signed one contract with a consumer electronics company, so there is everyone else out there … same with automotive,” Gerber said.

CdA vs. Seattle

In most of the articles written about Rohinni, it’s noted the company is not based in the tech hotbeds of Silicon Valley or Seattle, but in North Idaho. Gerber said it can be difficult being a tech company in a nontraditional tech community, but he plans on keeping the Rohinni lab in Coeur d’Alene because of what he sees as tangible benefits.

“Starting here, it is harder to find capital. So you have to work harder to do it,” he said. “You have to be smarter than the guy who is trying to raise capital in Seattle.

“It’s a little harder to find the talent. The plus side, though, is you can find world-class talent that wants to live in this area,” Gerber said. “Once you get them, it is so much easier to hang on to them because nobody is going to poach them from you.”

Push for capital

And the positive publicity certainly doesn’t hurt in a startup’s search for investors.

“Anytime one of these (startup) companies is able to get earned media through their actions, it helps them gain exposure. And that exposure is where they find investors, other companies to collaborate, potential customers,” said Todd Mielke, Greater Spokane Incorporated CEO.

Mielke said people who invest in startups are constantly getting pitches from companies. So when someone else is talking about the company, like CNBC with Rohinni, that helps open more doors to investors, he said.

To date, Rohinni has raised about $15 million, including the money from Fadell. But the company is looking to make a big push in 2018 and raise a lot more.

“You can’t stand still as a tech company. We have an opportunity to raise additional capital,” Gerber said. “I anticipate us raising a significant amount of capital – being in the $15 to 20 million range.”

The CNBC article mentioned Rohinni didn’t just say the company could be an investment magnant, it also said it could be bought.

“I would say when you’re in the tech business, you always have to be prepared for someone coming along and saying ‘we need to own this technology,’ ” Gerber said.

That is something Gerber has experienced firsthand. In the early 2000s, Gerber was a vice president at Liberty Lake-based Itronix. Itronix was acquired by General Dynamics Corp. in 2005, and the company moved Itronix operations to Florida in 2009 before shutting down the program in 2013.

“If I knew then what I know now, I would have stood up and opposed the deal harder,” Gerber told The Spokesman-Review in 2013.

That experience taught Gerber how important it is to look at your buyer, he said.

“It was a very painful experience for me … to see how those guys managed the business. And took a business that was healthy and took it down to nothing,” he said.

Because of that experience, Gerber said, that if anyone comes looking to buy Rohinni, he wants to advise the investors and board of directors to do what is best for the employees and the technology.