Travelers love airline flash sales but the ultra-cheap fares are becoming less common

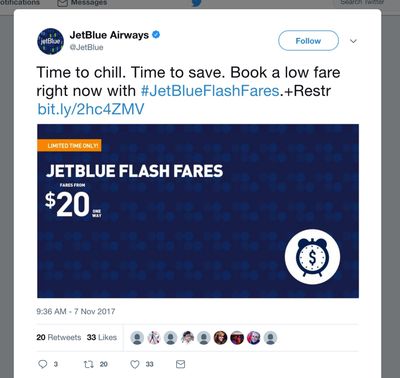

The Twitter ad seemed too good to be true: fares starting at $20 on JetBlue Airways.

A few hours after the ad appeared recently on the social media site, it was gone, leaving would-be travelers frustrated that they missed the remarkable deal.

Those who clicked too late ended up on a page advising: “This promotion has ended. Act fast! In some cases, a fare may not even last an hour.”

Such “flash” sales are a tactic used by the airline industry to fill empty seats during slow travel periods and lure travelers to an airline website where they may be tempted to book a more expensive flight.

Airlines also have used flash sales to inflict economic pain on rivals. Cutting prices on routes dominated by competitors often forces the other airlines to try to match the lower fares.

“It’s like kids in the airfare sandbox, fighting,” said George Hobica, a fare expert and president of Airfarewatchdog.com.

But such flash sales are on the decline, industry experts say, partly because the airline industry has become more consolidated through mergers and acquisitions, which has diminished competition and reduced the need to undercut rivals with limited-time fares.

And with demand for travel reaching record levels, carriers can sell seats without resorting to deep discounts.

Flash sales are also used less often today because computer programs have made airlines more accurate at estimating the number of seats needed for a particular route, so empty seats are rarer.

That means travelers looking for deep discounts are going to have fewer opportunities to book a bargain seat.

Since 2008, the nation’s biggest carriers have been buying smaller or weaker competitors, solidifying their dominance in specific markets and hubs throughout the country.

For example, Delta and its regional carriers fly nearly 80 percent of all passengers who travel out of the nation’s busiest airport, Hartsfield-Jackson Atlanta International Airport. American Airlines carries nearly 85 percent of all passengers at Dallas-Fort Worth International Airport. United Airlines is dominant in Newark Liberty International Airport, flying about 51 percent of all passengers who use the New Jersey airport.

Combined, Delta, United, American and Southwest control more than 70 percent of all domestic flights in the U.S.

Flash sales are now used primarily by low-cost airlines, such as JetBlue, as they continue to battle with the major carriers to win bigger shares of the country’s most popular markets and hubs.

A JetBlue representative declined to comment on the carrier’s use of flash sales.

Industry experts say the restrictions imposed on such sales are so numerous that the goal is not to make money from the low fares but to boost publicity and interest in the carrier.

“From a marketing perspective, you want to get likes or visitors or Twitter followers,” said Rick Seaney, who heads fare comparison site Farecompare.com.

Usually, flash sales are over within hours or minutes.

When JetBlue offered a $20 flash sale Aug. 30, it sold out in less than 60 seconds, according to the response from Twitter followers who tried unsuccessfully to book the bargain deals.

Instead of flash sales, Delta, United and American say they are competing against low-cost carriers by offering bare-bones fares – called basic economy seats – which are offered on highly competitive routes but come with fees for carry-on bags, rebookings and many other extras.

“We prefer to adjust prices on a longer-term basis – including reducing fares when needed, based on demand,” said Joshua Freed, a spokesman for American Airlines. “For us, flash sales are just not a great way to do that.”

Southwest, which has grown to be the nation’s largest domestic carrier, has cut back on flash sales over the past decade as it has established itself as a dominant carrier across the country, according to industry experts.

As a result, the Dallas-based carrier now offers flash sales primarily during the slow travel season – to fill seats on flights mostly flown by leisure travelers to vacation spots.

Southwest spokesman Dan Landson declined to discuss the carrier’s pricing tactics.